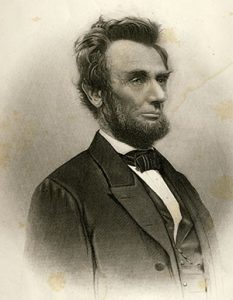

“Honest Abe” Lincoln understood that the significance of trust in forming productive and lasting relationships cannot be overstated. As a small business owner, it’s essential to understand that people want to do business with, work for, and purchase products or services from businesses built on a foundation of honesty and integrity. Even the most loyal colleagues, employees, vendors, and customers will lose faith in businesses that prove to be dishonest or fail to keep their commitments.

“Honest Abe” Lincoln understood that the significance of trust in forming productive and lasting relationships cannot be overstated. As a small business owner, it’s essential to understand that people want to do business with, work for, and purchase products or services from businesses built on a foundation of honesty and integrity. Even the most loyal colleagues, employees, vendors, and customers will lose faith in businesses that prove to be dishonest or fail to keep their commitments.

At Summit Financial Resources, building trust with our clients begins and ends with being truthful, delivering on our promises, and continually meeting or exceeding expectations. We specialize in lending programs designed to give small businesses like yours the working capital to keep your company growing. As the primary point of contact with our clients, our Relationship Managers understand that trust, respect, and communication are the keys to keeping clients happy and creating long-lasting relationships.

Honesty is a Two-Way Street

Our clients must be able to rely on us to always have their best interests at heart, and our Relationship Managers want to help you and your business in any way they can. They are eager to share their knowledge and expertise and to provide answers to your questions or explanations when there is something you don’t understand.

Our Relationship Managers are also great listeners. We believe that getting to know our customers is the key to creating the best possible financing options for their businesses. You can trust that your challenges will be heard and your concerns will be taken seriously. In our experience, working with a lender who understands you makes for a better partnership down the road.

Apply online and get started today >

By practicing a policy of openness, we are working to establish an environment where our clients feel comfortable being open with us in return. Our Relationship Managers are committed to offering unbiased professional opinions and candid points of view, but they are only as good as the information they have to work with. It is imperative that you provide what they ask for in a timely manner, with as much detail as possible.

This means coming clean when the news is bad. If you owe back taxes or are facing a serious cash flow crunch, being upfront will enable your Relationship Manager to partner with you to help resolve the issues. The bottom line is the more you’re willing to share with us, the better we are able to meet your current borrowing needs and analyze and assess them on an ongoing basis.

Keeping Promises is Essential

For any relationship to work, there has to be trust on both sides. Call us old fashioned, but we follow the Golden Rule and treat others as we would like to be treated. We understand that if we expect our clients to have confidence in us, we have to earn their confidence by delivering on what we promise.

Trustworthy businesses not only say what they mean, they do what they say. If your small business is involved in our invoice factoring program and we have committed to providing an over-advance or a wire by a certain time, we know it’s critical to follow through. Failing to do so may compromise your ability to pay bills on time or make payroll. On the flip side, if a client’s request is unrealistic or we know we can’t fulfill it, we believe it’s far better to be honest than to make empty promises we can’t keep.

Consistency Builds Trust

Consistency helps establish trust. This means not only offering customers reliable products or services but going above and beyond when it comes to service. If a customer is promised a delivery on a certain date, or a promotional offer, or a callback at a specific time, it’s vital that you and your team consistently meet expectations. Better yet, offer even more than initially promised such as shipping a product sooner or offering an additional discount.

Proving to your customers that they can count on you to continually meet or exceed their expectations will build trust and generate repeat business and referrals. According to a recent survey by Concerto Marketing Group, when customers trust a brand, 83% will recommend the company to others and 82% will continue to use the same brand.

Cultivate a Culture of Transparency

At Summit Financial Resources, we understand that one of the keys to building positive relationships with those outside of our business is to create a company culture that promotes trust and transparency. Miscommunication and a lack of openness can result in confusion and leave employees feeling out of the loop and underappreciated. Your entire team, from top to bottom, needs to feel informed, included, and inspired to stay involved.

One way to build a more supportive company culture is to reinforce the trust relationship between managers and employees. Rather than micromanaging, having confidence in your employees’ ability to accomplish their work and giving them the autonomy to do so can lead to greater engagement and productivity.

A culture grounded in self-sufficiency encourages independent thinking and creative problem solving, which can result in a greater sense of accomplishment. Satisfied employees tend to be more loyal and invested in creating the kind of positive relationships with customers, vendors, and business associates that will contribute to a healthy future for your company.

The success of any small business hinges on its reputation for being honest, reliable, and responsive. Summit Financial Resources understands that developing and maintaining relationships based on mutual trust and respect is essential to creating a win-win for your business and for ours.

Working Capital Financing is a few clicks away.

Apply online and get started today >

Summit Financial Resources specializes in working capital financing for small to medium-sized businesses that need increased cash flow. We provide working capital financing through invoice factoring, asset-based lending, inventory lending, and equipment financing.