By: Michael A. Toglia

In February 2021, Solar Capital Partners announced the company’s name change and rebranding to SLR Capital Partners (SLR). The new name utilizes a common brand across its affiliates and specialty finance investment teams. SLR offers a comprehensive suite of commercial finance capabilities and seeks to build complementary lending strategies. SLR’s platform provides a broad range of senior secured financing alternatives – providing customized solutions to meet borrowers’ financing requirements and is comprised of eight groups focused on a variety of financing solutions to meet working capital, growth capital and liquidity requirements of middle-market companies.

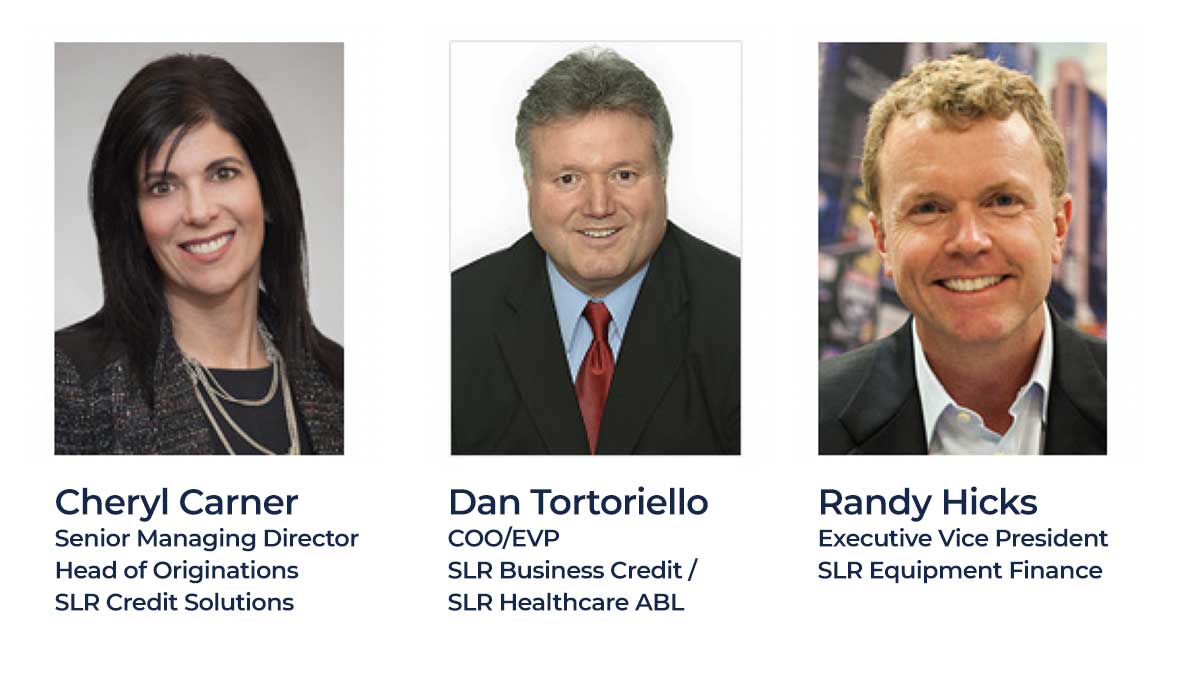

ABL Advisor met with the leaders of three groups under the SLR Capital Partners umbrella to learn more about this company-wide initiative to effectively tackle the needs of an evolving market.

We spoke with Cheryl Carner, Senior Managing Director – Head of Originations of SLR Credit Solutions, formerly known as Crystal Financial; Dan Tortoriello, Chief Operating Officer of SLR Business Credit, formerly known as North Mill Capital; and Randy Hicks, Executive Vice President of SLR Equipment Finance, formerly known as Nations Equipment Finance.

ABL Advisor: Thank you all for joining us today. Please tell us about your individual businesses – the types of financing products that you provide, your target market by sector and transactions, credit profiles, and if you work only on a direct basis, or if you also work through intermediaries?

Cheryl Carner (SLR Credit Solutions): SLR Credit Solutions, which was formerly Crystal Financial, provides senior and junior secured debt financings with transaction sizes ranging from $20 million up to $125 million. We have the flexibility to lend against all types of asset classes – covering working capital as well as fixed assets, real estate and consumer brands. We also can provide cashflow transactions for companies that have EBITDA greater than $25 million. Our borrowers are a very diversified range of companies. They typically have revenues of $50 million or more and can be multi-billion-dollar companies as well. They can be public, private equity-backed or privately held, and we are industry agnostic, but we do have expertise in a variety of sectors, which include retail consumer, business services, industrial and B2B specialty finance. Our transaction opportunities primarily comes from intermediaries as well as other lenders. This includes a wide range of investment bankers, other types of advisors, private equity firms, asset-based lenders, as well as other more direct competitors to SLR Credit Solutions. We cover the U.S. and Canada.

ABL Advisor: Dan, please tell us a little bit about SLR Business Credit, which was formerly North Mill Capital. Can you tell us about your target market and some of the things that Cheryl just talked about?

Dan Tortoriello (SLR Business Credit): We’re very interested in transactions from half a million dollars on a revolver up to a hold position of $20 million. We also offer a factoring product. We can look at transactions with as low as a $100,000 a month in sales and growing. In addition, we go up to $20 million on a factoring basis. With the Solar Capital balance sheet, we can do much larger transactions; this is where we may experience some crossover with the other groups within Solar Capital. We do not offer mezzanine/cash flow facilities nor equity. We are a senior secured lender and provide advances against accounts receivables, inventory, and machinery and equipment. The main industries we focus on are staffing and service providers. We also work with a lot of importers and distributors. We have a concentration in frozen food distribution. In addition, we have a concentration in manufacturing because we can provide both a revolver and term debt. Our referral sources are very similar to what Cheryl mentioned. Bankers are our most productive referral source. We also work with private equity firms, family offices and other intermediaries. Our geographic scope is the U.S. and Canada.

ABL Advisor: Thank you Dan. Randy please provide us with a bit about SLR Equipment Finance, formerly known as Nations Equipment Finance.

Randy Hicks (SLR Equipment Finance): SLR Equipment Finance, formerly Nations Equipment Finance, is a middle-market equipment finance company. We work in numerous sectors including manufacturing, construction and transportation. The equipment can be over-the-road, rail, marine and coach bus operators. We also cover the food space, mining, and logging and forestry in the natural resource space. We work with companies that are making CAPEX purchases over the course of a year, or refinancing equipment, and we cover a broad range of equipment types. Generally, we finance critical use assets. They may not always be sufficient to fully collateralize a transaction, but they’re critical use and usually long-lived assets. Our target market is bankable or near bankable credits that are generally fixed asset-intensive. Financing structures include term loans and various types of leases, both tax-oriented leases and non-tax-oriented leases, and sale-leasebacks as well. Transaction size ranges from about $2 million to $50 million. And again, as I mentioned, we might do a $10 million transaction for a company where the collateral value today is worth 50 or 60 cents on a dollar, but it’s a critical use asset to the company. We have BDOs in various parts of the country and we also source business via a network of brokers, advisors, turnaround firms, etc. We cover the U.S. and Canada from a geographic standpoint.

ABL Advisor: How do you feel this branding change will impact the way SLR Credit Solutions is perceived in the market by both borrowers and other financial institutions?

Carner (SLR Credit Solutions): I think the biggest change is likely that there’s an awareness now that our businesses are related and united under this common platform. I believe there were some people who knew that North Mill Capital, Nations Equipment Finance and Crystal Financial were all related, whether you want to call us cousins or siblings, but there were a lot of people who had no idea. I think the most impactful dynamic likely is to the private equity community because whenever we or our colleagues at SLR Capital Partners are meeting with private equity firms, we can very naturally talk about the breadth of all the different products and financing tools that we offer. Typically, when we’re speaking with either borrowers or referral sources, it’s usually clear what type of product and/or solution is needed. If someone calls me for a factoring need, I send that opportunity to Dan, or if it’s a smaller asset-based opportunity, say $10 million or $12 million for example, again, I send it to Dan. When I get calls on equipment finance opportunities, that goes over to Randy. So, I think that it’s the awareness will be helpful, but it doesn’t necessarily change anything in terms of our products or capabilities, how we do what we do and how we interact with each other.

ABL Advisor: Dan, let’s go back to you. Is there anything that you want to add to what Cheryl said? Is it more about the awareness or anything else from your perspective?

Tortoriello (SLR Business Credit): What Cheryl said is very important. We want our referral sources and our clients to know that just because we’re part of a large organization, it doesn’t mean we’re gravitating away from what we did in the past. We still want to do the million-dollar revolver but now we have the ability to do a $20 million facility or larger. We need to make sure referral sources understand we’re still doing business the same way. The fact is, if you have a transaction, come to us. If we’re not the right fit, we’ll tell you that. But because of the diversity and experience within the organization, we now have a larger bandwidth and can leverage that experience to better service the prospect by placing the transaction with the right group and not trying to force a square peg in a round hole.

ABL Advisor: Randy is there anything you would like to add?

Hicks (SLR Equipment Finance): I think we’ve covered most of it. Hopefully, down the road, the brand awareness that these individual brands each brought to the table will truly transcend to the SLR brand.

ABL Advisor: Please tell us how you’ll be working together to bring forward this unified approach Do you see that being something more focused upon now?

Hicks (SLR Equipment Finance): It started for us when we were acquired three years ago, but it really came forward last year. Cheryl, Dan and I each participate on a weekly call – at least one call a week – with the overall SLR platform including both risk and sales. In these broad conversations, folks talk about their individual portfolios and their individual origination efforts, but it often dovetails into how we can be working together. It’s a company-wide call for originations and risk, but it often dovetails into a one-on-one conversation. Dan and I sharing opportunities or Cheryl and I with our respective BDO teams.

Carner (SLR Credit Solutions): We do our best to harness the power of all the expertise our entire SLR team brings to the table. Randy and his team’s experience with equipment values have provided us the knowledge and confidence to provide joint proposals on business opportunities that are fixed asset-intensive. This approach demonstrates a powerful ability to leverage this knowledge and provide certainty of execution. We’ve also worked with Dan and his colleagues when we are evaluating an opportunity with account receivable where their perspective and insight is incredibly helpful.

ABL Advisor: Dan, did you want to add anything to what Cheryl shared? Is there anything about the unified approach and what that means to you that you would like to add?

Tortoriello (SLR Business Credit): Yes. One other thing I could add is that prior to COVID, we would have a group meeting of the sales force, so everyone can get to know each other, and the products offered. Overall, we’re a flat organization, so we are all available to discuss a transaction. This covers the credit side, to the new business side, to operations. If you need to speak with any of us, we welcome the call. This also allows for quick responses. Our view is to review a transaction and see where it fits. We try to make our process cohesive and work closely together doing it.

Carner (SLR Credit Solutions): To Dan’s point, we’ve also worked hard to ensure that each of our respective teams of business development professionals, who are typically geographically focused, know their counterparts in other markets. The best thing that I hear is when we’re on our pipeline call and a person on my team says that business credit called and is looking at X or Y and we have the deal to work on now in our group. It’s terrific to see these professionals really leverage each other.

ABL Advisor: How do you see the balance of 2021 playing out in terms of new business volume for your individual groups? Dan, we’ll start with you this time.

Tortoriello (SLR Business Credit): We were at a peak the first quarter of 2020, and then we all saw a large reduction with the stimulus money, which became a blessing and a curse for us. Our loan to collateral values got better, but our outstandings dropped dramatically during that time. So, we’re coming back from that situation. We’re well off our low point and we’ve seen more activity. We’d love to see even more because we have a solid liquidity base to grow. We are still not experiencing consistent growth like that of the first quarter of 2020, but the thought is that the COVID vaccine is going to play a big part in this recovery. Thus, we look to see some growth in both our current portfolio and new business. We’re more than 60 percent back from our low. So, it’s coming back.

ABL Advisor: Cheryl, how do you see the balance of 2021 playing out for your group?

Carner (SLR Credit Solutions): I think it’s going to be a challenge, but consistent with the challenges we see each year, because every year we have robust and very healthy AUM growth targets. Every January, we are not quite sure how we’re going to accomplish our goals but, every year has its surprises and opportunities. Last year at the onset of the pandemic, there was an initial view that there would be a massive wave of restructuring activity, which would certainly benefit all of us here. That really didn’t happen. It didn’t happen just because of the sheer massive volume of monetary stimulus that was put into the system. Also, there are many yield-starved investors looking for places to deploy capital. There is a lot of money chasing the spaces that we all play in. We need to navigate all those headwinds, but I do agree with Dan that there are also potential tailwinds for later in the year, where there will be more spending, more overall economic activity, more CAPEX for Randy and equipment finance. That should hopefully translate to more financing opportunities as well.

ABL Advisor: We’ll wrap it up with you, Randy. How do think about the balance of 2021 will play out for the Equipment Finance group.

Hicks (SLR Equipment Finance): There will be significant growth over 2020 that’s for sure, but that’s not a high bar necessarily. Cheryl’s comments are on target. It is going to be CAPEX driven because of where we are in the economic cycle. I believe demand is going to come back. Many of the assets we finance depreciate rather quickly, and therefore they need to be replaced. So, I see a very strong 2021 for us. The hedge against that is the amount of the competition. Demand is there and probably beyond where it was in the first quarter of 2020 with the same or more players and liquidity in the market. So that’s my hedge, but it will be a good year.

About ABL Advisor

ABL Advisor’s mission is to consistently deliver the highest-quality, most advanced, comprehensive, engaging, and resource rich publishing resources available to commercial finance professionals nationally.

Our audience includes finance professionals from national, regional and community banks; commercial finance companies, turnaround management and bankruptcy professionals, attorneys, accountants, service/product providers and more.